Dec 10, 2015 (LBO) – Sri Lanka’s currency adjustments which are poorly timed affect business planning and confidence of international community while having other effects, a senior researcher said.

Nishan de Mel, head of research at Verite said that in Sri Lanka, the strength of rupee is incorrectly tied up with economic virility.

“We know that politically in Sri Lankan society the way in which the economic ideas have been percolated says that the value of your currency is a sign of your virility,” he said.

“Economic virility and the strength of currency are somehow brought together mistakenly,” De Mel said.

He was speaking at the LBR LBO Debrief conference held in Colombo on Tuesday.

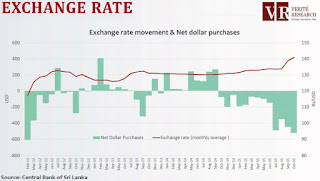

De Mel said the currency stayed flat for over 8 months before it suddenly increased in September after the general elections, a sign of a failure to gradually adjust the currency.

“Before the election it was not possible to allow the currency to adjust. But you pent up all that suppressed pressure and let it go suddenly,” he said.

“It is of course terrible in terms of business planning and confidence of international community when your currency adjustments are not smooth.”

De Mel however said the currency adjustment problem is not only a political issue but also an issue of poor volatility management by Central Bank.

“There is no problem in the currency adjusting if you manage it in a way that the adjustment of a currency off sets the interest rate that Sri Lanka has over the US dollar,” De Mel said.

“The problem is when you are depreciating the currency at 1 percent a month then everybody is trying to clear out when these volatile depreciations are going to take place.”

He said the role of Central Bank’s professional management of a currency is really to manage a much smoother path of currency depreciation that doesn’t create incentives of capital flight.

“But from the 1990s onwards, the Central Bank has been really quite poor at that. Many people thought just because the currency has been a strong or stable against the US dollar; that’s great,”

“But it’s not great because it just means that it is going to jump up one day and everybody is going to have speculative issues around when that’s going to happen.” De Mel further said.

No comments:

Post a Comment